Do you know that you can get up to N200,000 loan on Alat loan? If yes then this article is for you.

Here is another loan provider that focuses more on helping individuals eliminate their financial crisis and monetary difficulties.

Most importantly, it’s a collateral-free loan and is accessible to any person whether employed or self-employed.

In this article, we will focus more on Alat loan requirements, repayment plan, interest rate, contact number and how to apply.

Before we go down to business, lets quickly explain what Alat loan is all about.

What is ALAT loan?

ALAT is Nigeria’s first fully functional digital bank sponsored by Wema bank. Alat does not only focus on providing loans to individuals, but the platform can also be used for some other things like bill payment(electricity, Nepa, GOtv, and DSTv), buying of airtime and many others.

Note, you do not need any collateral or to visit any branch or bank before you can be able to access a loan from Alat.

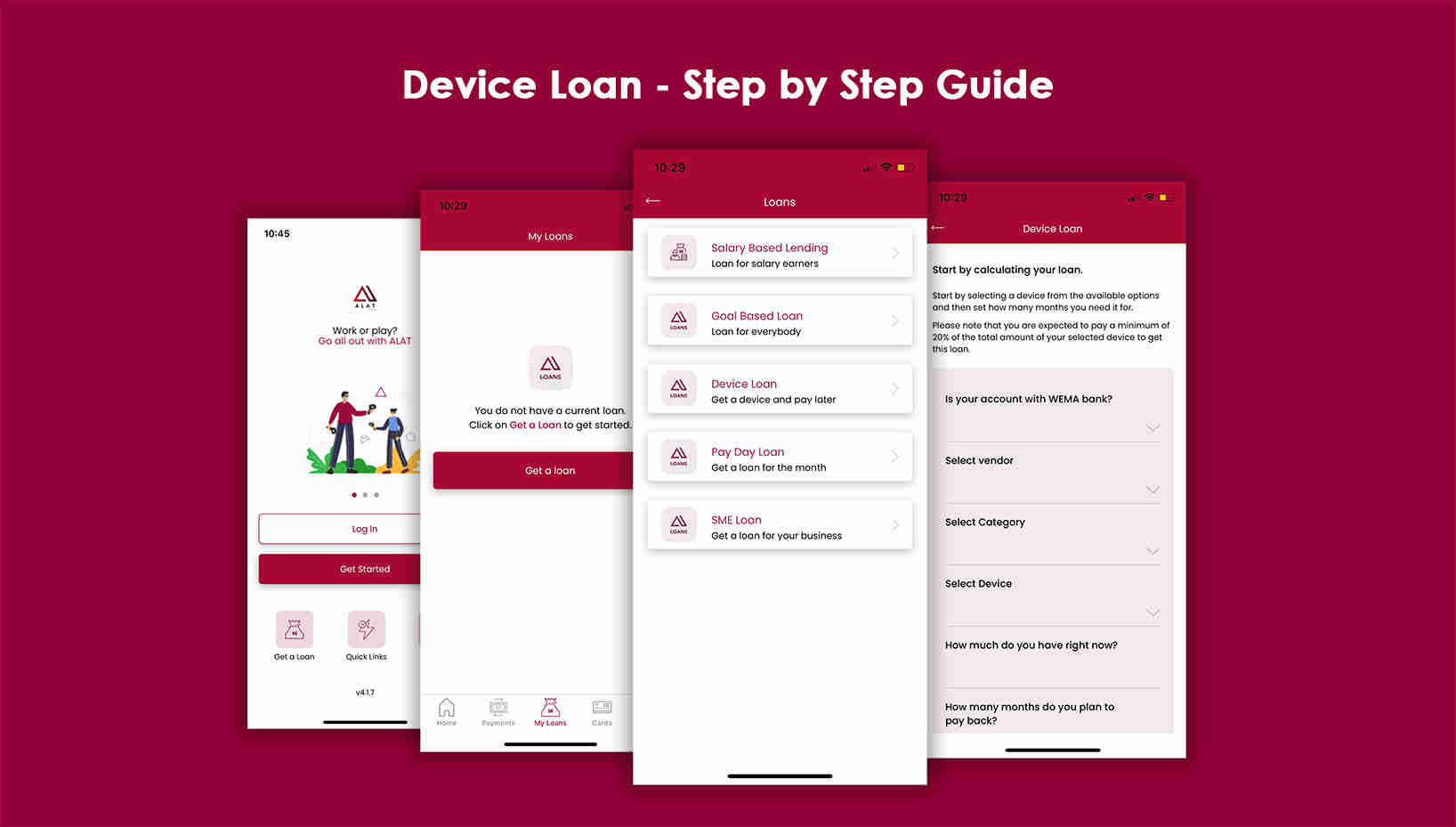

How to apply for an Alat loan

Applying for a loan on Alat is one of the easiest things you can ever think of, you don’t need to undergo any stress like visiting their branch or filing any paper, it’s just easy and simple;

- First, you need to download and install the official app from your Google play store or Apple store.

- Then log in to your Alat app or sign up in case you have not.

- From the menu on the app, click on loans.

- Fill in the necessary information.

- If your Alat accepts your application, your account will be credited immediately.

We always advise you to read the terms and conditions carefully before applying for a loan on any loan provider.

How to pay back Alat loan

If your loan is still outstanding at the payback date, you will get a repayment notification from Alat and after the notification, your account will be automatically debited.

Also, you can visit any Wema branch near you for further inquiries on how you can make a loan repayment.

Note that if you fail to pay back your loan on the agreed date, Alat will place a late repayment fee on your account and finally, they will report you to the credit bureau and as a result of that getting a loan from other loan providers won’t be possible.

Alat loan interest rate

The Alat loan interest rate varies from person to person this means that the interest rate Mr. A gets will be totally different from the interest rate Mr. B will get.

For instance, if Mr. A has a good credit score more than Mr. B, their interest rate will be totally different.

However, the flat interest rate on the Alat loan is 20% per year.

On your loan approval, your interest rate and loan duration will be shown to you.

NOTE, we always advise you borrow the amount you can pay back because any default in payment will be reported to the credit bureau making it difficult for you to access loans from other loan providers. Most importantly, it can as well as affect your employment.

How much can I get from Alat loan?

The maximum amount you can get from the Alat is N200,000 with a 20% interest rate per year.

It’s also possible for you to access up to N2million naira on your first application provided you meet with there requirements.

Alat loan requirement

The requirements for getting a loan from Alat are what everyone can afford, its not hard or stressful everything is done online.

- First, you need to have a cell phone which you can use to download the app.

- secondly, maintain a good credit score.

- Then finally, you need a standard savings account. Note that you cannot get a loan with an Alat Lite account.

For you to upgrade your Alat lite account, you need to upload a clear government-issued identification card, the government-issued ID card can be your international passport, national identification card, valid voters card or a valid drivers license alongside with your utility bill.

Note that the utility bill you upload must have the same address, name and other personal details with the government-issued identification card you uploaded.

Read Also: Branch Loan SMS Number: Contact Number, Requirements,

Quickcheck loan: Requirements, Interest rate, Contact Number, How To Apply

XtraCash Loan: Requirements, Interest Rate, Contact Number, How To Apply

Access Bank PayDay Loan: Everything you Need to Know

Sokoloan Office Address in Lagos; Exact Sokoloan Office

Reasons why people apply for an Alat loan.

There are so many reasons why people apply for an Alat loan, it can be for an urgent medical need, for business expansion, to buy a car or fix a car issue or for traveling purposes.

Alat loan contact number/customer care service

Should in case you encounter any technical problem while applying for the loan, you can contact them through email on [email protected] or contact them through there customer care number @ 070022552528.

Features of Alat

Apart from borrowing, Alat has so many other features which made them be different from other loan providers who only focus more on lending, these features are listed below;

Make Payments

- To pay a bill, choose a biller to pay to from the appropriate category then type your customer ID.

- Next, choose the account to pay from, type your ALAT PIN and click the ‘Pay’ button.

- If you pay this bill regularly, save the biller and schedule your next payment.

Send Money

- To send money from your ALAT account, click the ‘Send Money’ button on the ALAT dashboard then click on the ‘New’ button.

- Type in the account number of the receiver and select their bank from the options provided.

- Save the receiver’s banking information.

- Next, choose the account to send money from, type in your ALAT PIN and click the ‘Send’ button.

- Now that you know how to send money on ALAT, let’s show you how to buy airtime and pay bills.

If you have any question concerning this particular loan provider or other loan providers which we have written on Payglobal, you can use the contact page to reach out to us we are 24 hours ready to attend to your questions.