What is the journal entry to record a foreign exchange transaction

$ 8.00 · 4.9 (765) · In stock

A foreign exchange transaction gain occurs when the transaction currency is different than the reporting currency for the company. On the initial transaction date, they would record the $100 sale with a debit to accounts receivable and a credit to revenue. However, 30 days later when the customer goes to pay using the current exchange

Things to remember in Foreign Currency Valuation - SAP Community

Entering and Processing Foreign Currency Journal Entries

How to Include Journal Entries When Accounting for Bonds

Three common currency-adjustment pitfalls

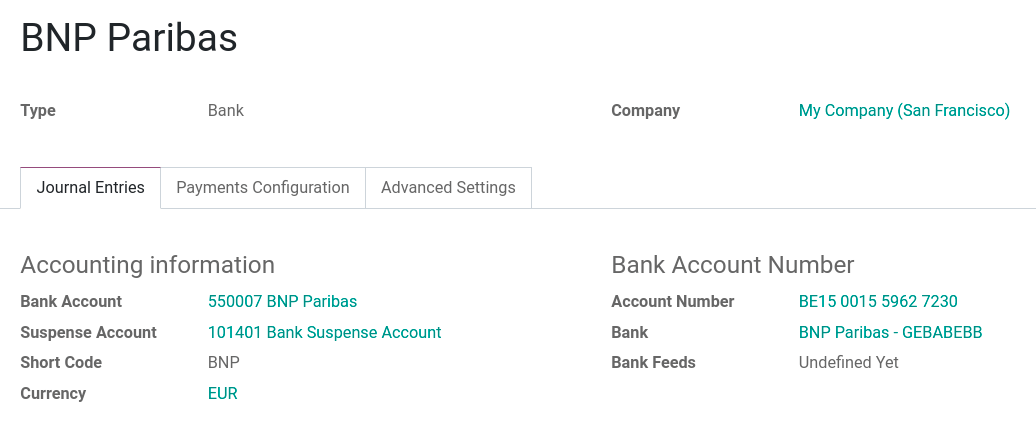

Manage a bank account in a foreign currency — Odoo 17.0 documentation

Advance Acctg Foreign Currency Problems, PDF, Exchange Rate

Accounting Treatment of Bills of Exchange - GeeksforGeeks

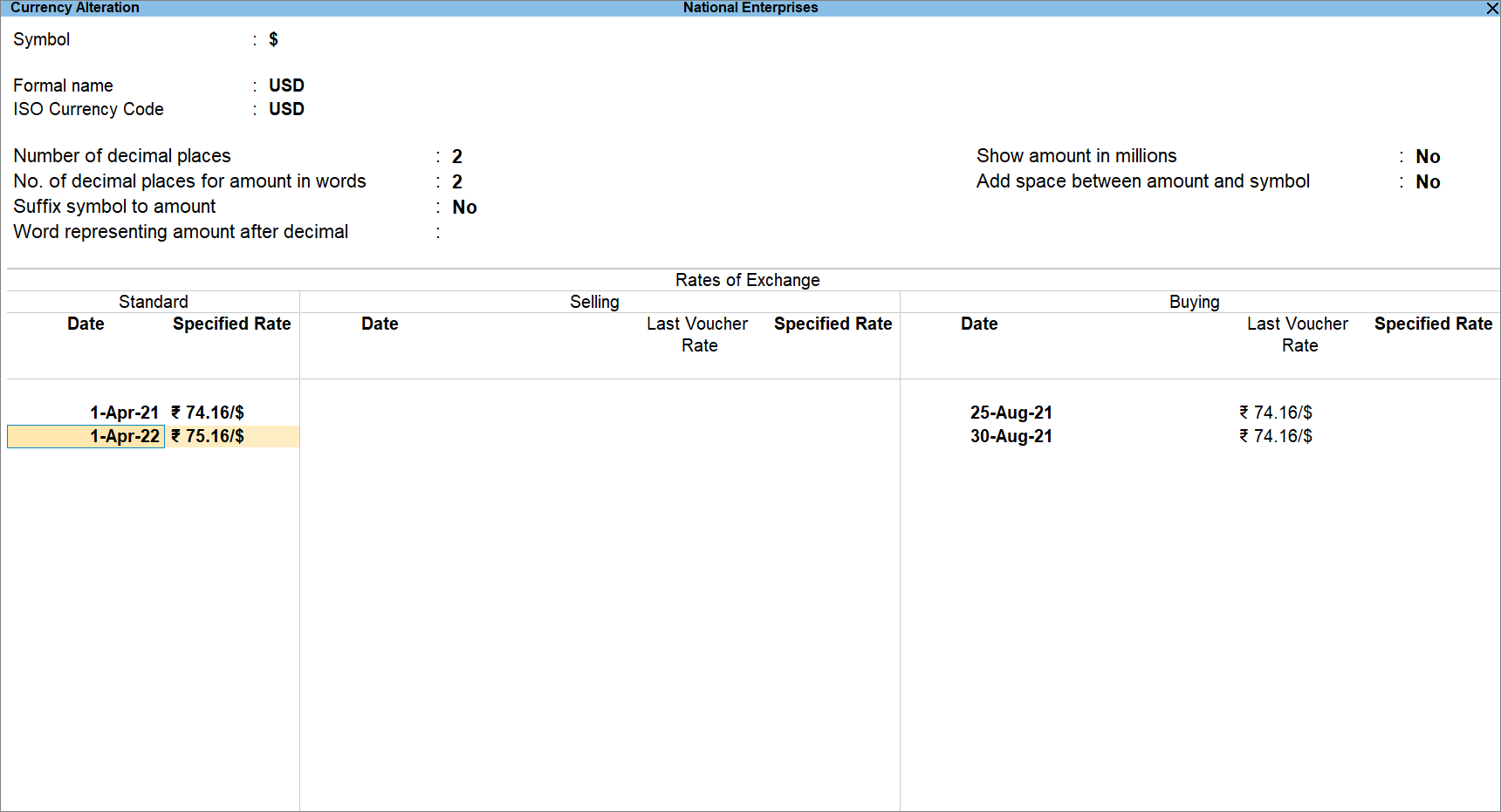

Currency in TallyPrime - FAQ

How to Record Transactions in Multiple Currencies in TallyPrime?

Forex Probs, PDF, Exchange Rate

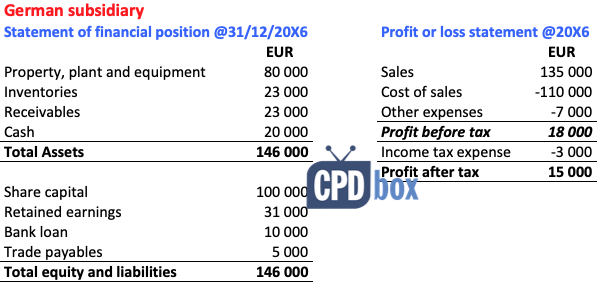

Example: Consolidation with Foreign Currencies - CPDbox - Making IFRS Easy

Journal Entries in Accounting with Examples - GeeksforGeeks

Foreign exchange market - Wikipedia

Accounting Entries For Foreign Exchange Transactions

SOLVED: Journal entries for an account receivable denominated in Euros (USD weakens). Assume that your company sells products to a customer located in France on October 15. The invoice specifies that payment

,aspect=fit)

:max_bytes(150000):strip_icc()/Unrecaptured-1250-gain_final-f74610188e8542aba3a79c35408552b9.png)