Qualified Vs Non-Qualified ESPPs

$ 9.00 · 4.9 (612) · In stock

Qualified vs Non-qualified ESPPs. We take you through an explanation of what they are, their differences and which one is best for you as an employee.

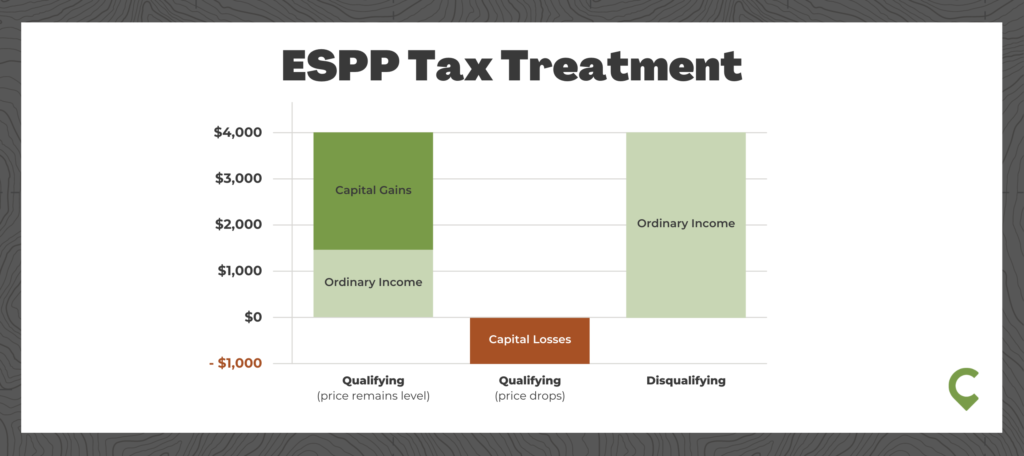

This post explains the two main types of employee stock purchase plans (ESPPs), detailing the differences between them and their tax implications.

ESPP: The Five Things You Need to Know

Detailed Breakdown of an ESPP Qualifying Disposition — EquityFTW

Qualified vs Non-qualified Stock Options - Difference and Comparison

What Is An ESPP? An Introduction Guide

espp discounts - FasterCapital

stock purchase - FasterCapital

Introduction To Espps And Qualified Dispositions - FasterCapital

Employee Stock Purchase Plan - ESPP (Infographic Included)

espp discounts - FasterCapital

Introduction to Employee Stock Purchase Plans – ESPP

Should I Participate in ESPP at Work? 5 Situations to Consider.

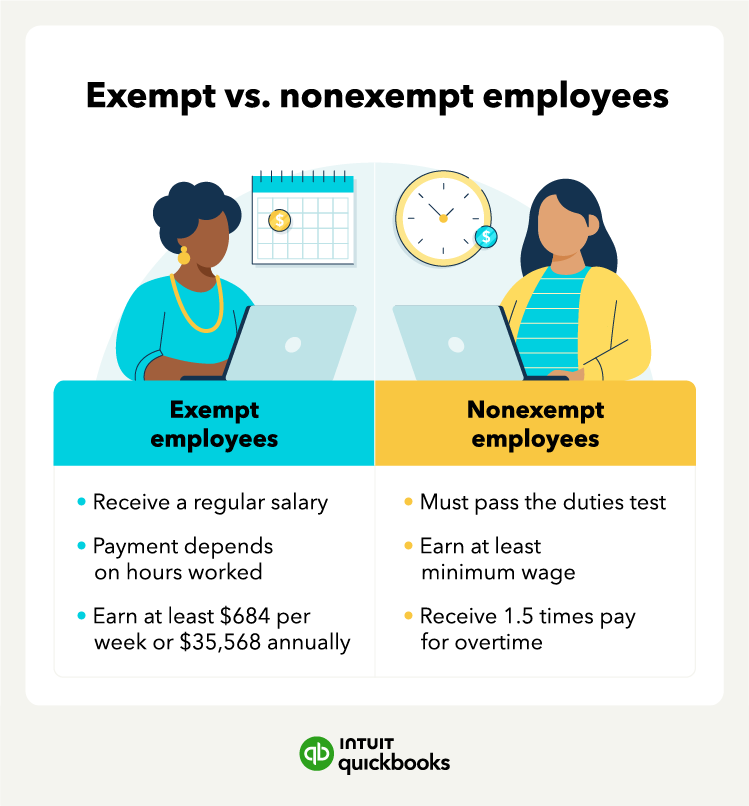

Qualified vs Non-qualified ESPPs: A Comparative Analysis