Depreciation Methods - 4 Types of Depreciation You Must Know!

$ 27.99 · 4.9 (312) · In stock

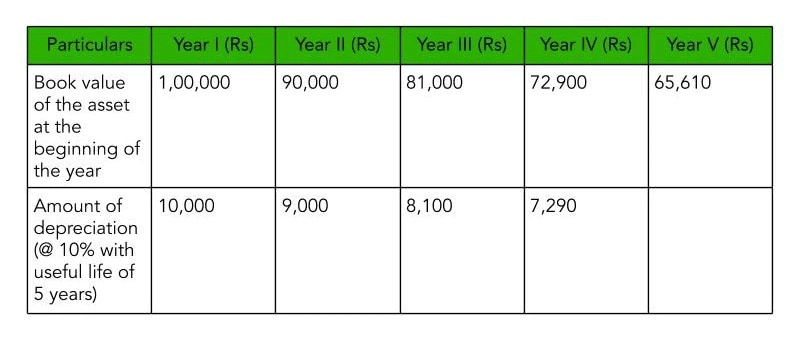

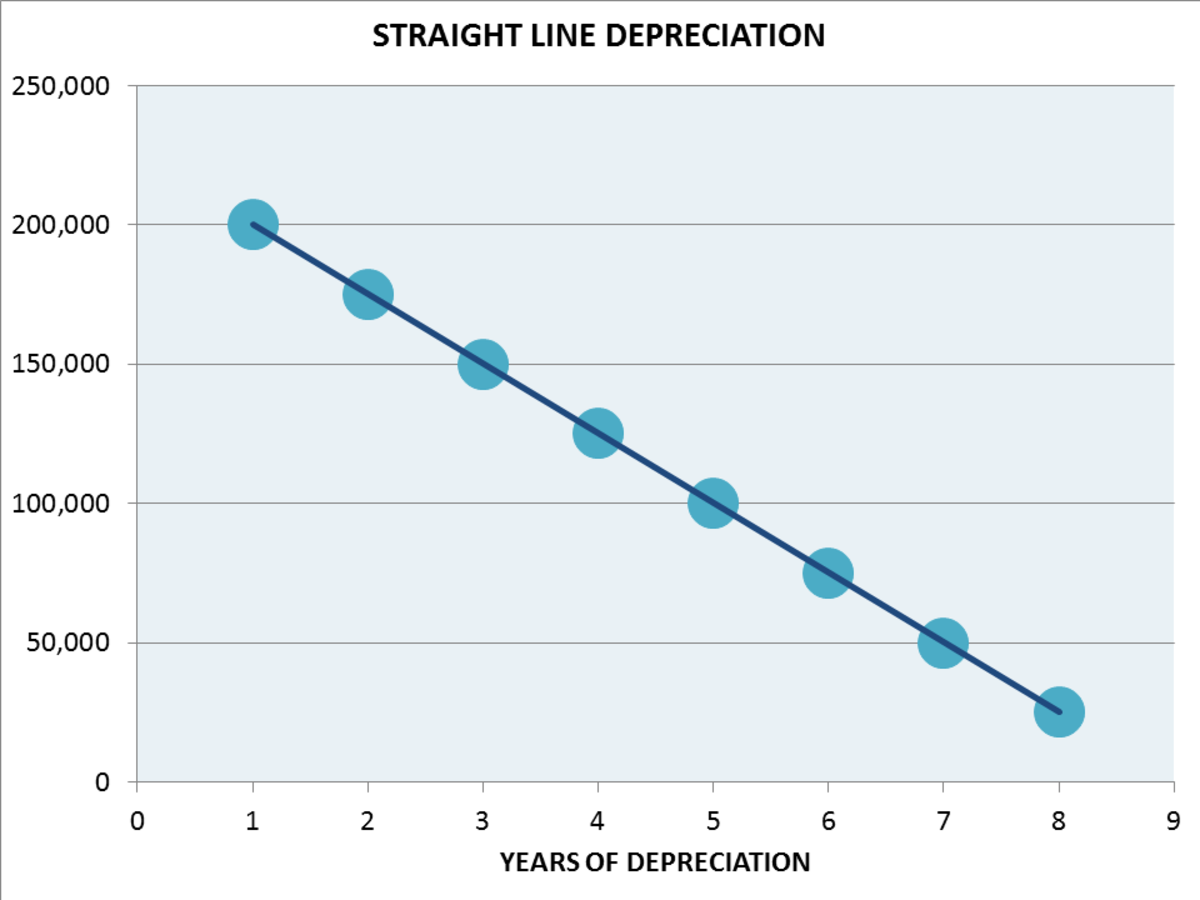

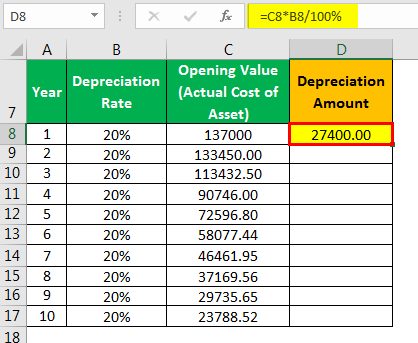

The most common types of depreciation methods include straight-line, double declining balance, units of production, and sum of years digits.

Depreciation Methods: Check Formula, Factors & Types - QuickBooks

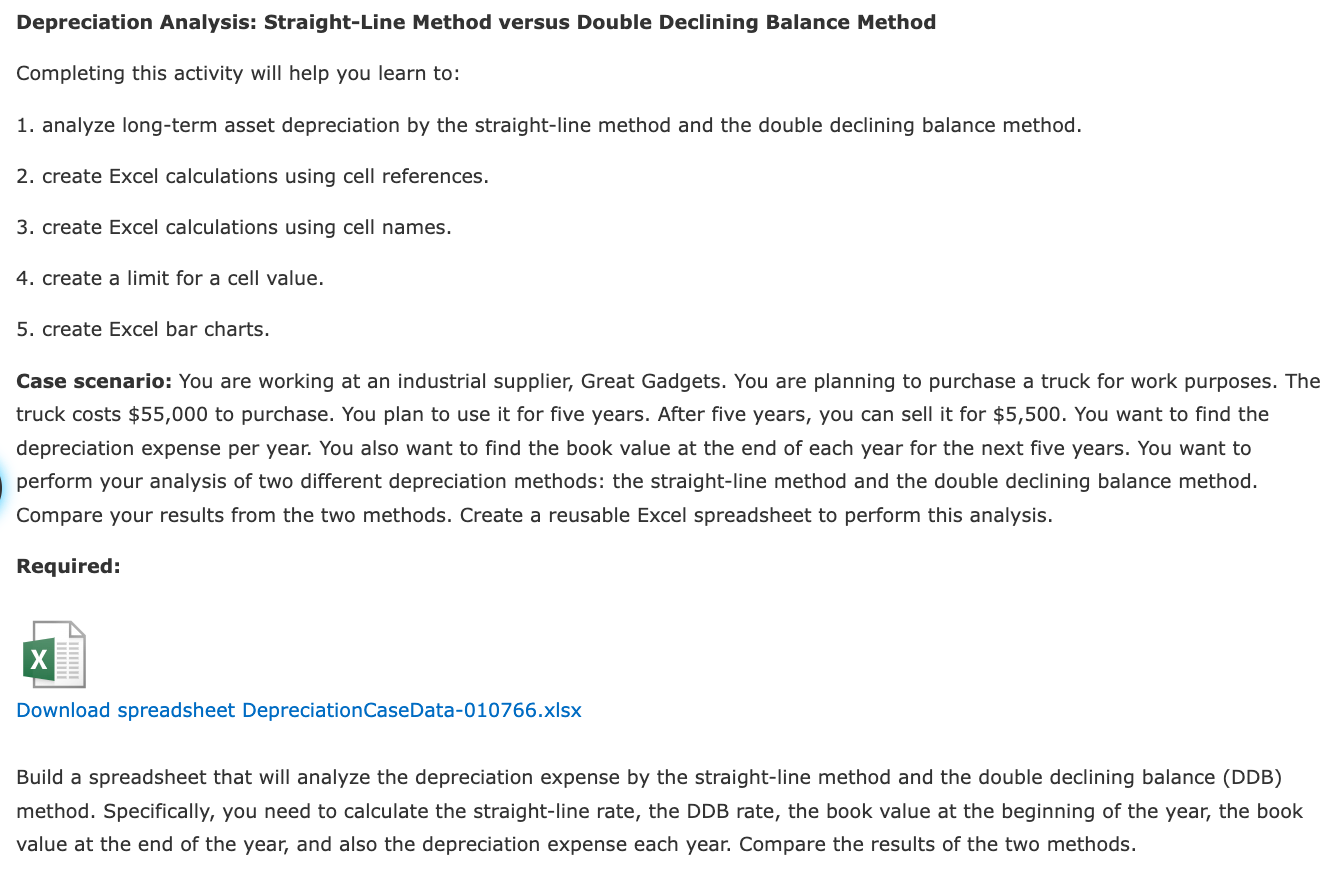

Solved Depreciation Analysis: Straight-Line Method versus

8 ways to calculate depreciation in Excel - Journal of Accountancy

Depreciation: What is it and How to Calculate it? - Happay

Straight Line Method Of Depreciation Example – Otosection

Types of Depreciation Methods - FasterCapital

ACC 610 FINAL PROJECT MILESTONE 3.docx - Running head: ACC - 610 FINAL PROJECT ACC - 610 FINAL PROJECT MILESTONE THREE Colleen McDaniels Southern New

Calculating Depreciation - Unit of Production Method

Types Of Depreciation Methods And Their Pros And Cons - FasterCapital

Depreciation Formula Calculate Depreciation Expense

What is the purpose of the double declining balance method? Why is it 'double' as opposed to 'single' or 'triple'? - Quora

PaolaKu-Cobb

Calculate Depreciation Expense

Capitulo 4 - La Depreciacion en Las Construcciones, PDF

Types Of Depreciation Methods And Their Pros And Cons - FasterCapital

:max_bytes(150000):strip_icc()/types-of-psychologists-and-what-they-do-2795627_v1-9a9b856f7d1c494aafb96f59e4843f55.png)

:max_bytes(150000):strip_icc()/bricks-types-uses-and-advantages-844819-v4-dfd8be11b5034809aa3d9a2f117ad79b.png)