Andorra Limited Liability Company (LLC) Formation

$ 13.99 · 5 (623) · In stock

Andorra Limited Liability Company (LLC) formation can conduct any type of business without paying high tax rates. The corporate tax rate is only 2%.

Principality of Andorra: 2023 Article IV Consultation-Press Release; Staff Report; and Statement by the Executive Director for the Principality of Andorra in: IMF Staff Country Reports Volume 2024 Issue 057 (2024)

Setting up a company in Andorra - Andorra Lawyers

Setting up a company in Andorra - Andorra Lawyers

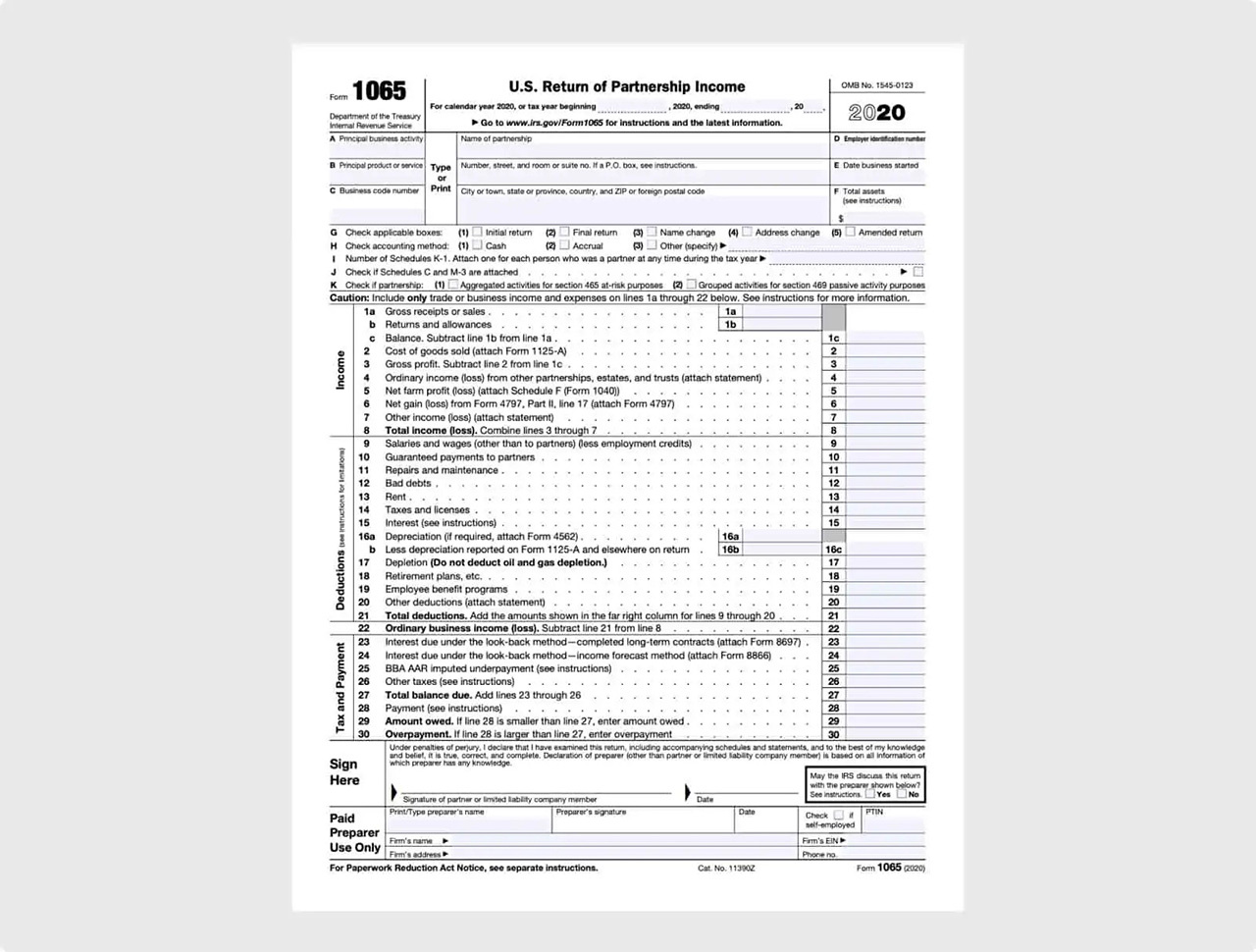

How the LLC Pass-Through Taxation Works

Company Formation in Andorra

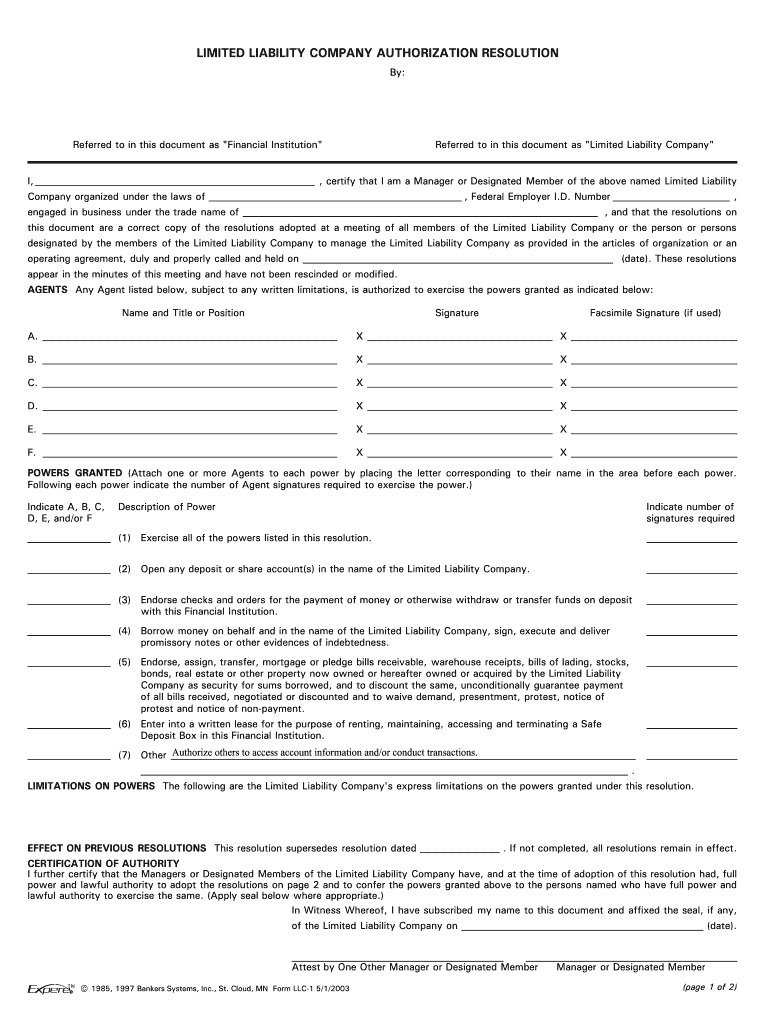

Llc resolution for signing authority: Fill out & sign online

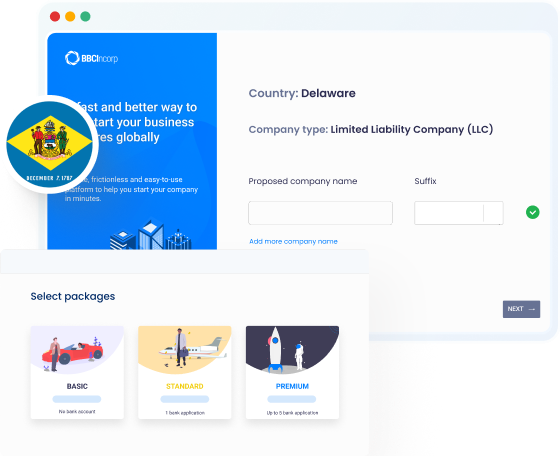

Delaware Company Formation for Non-residents With Bank Account

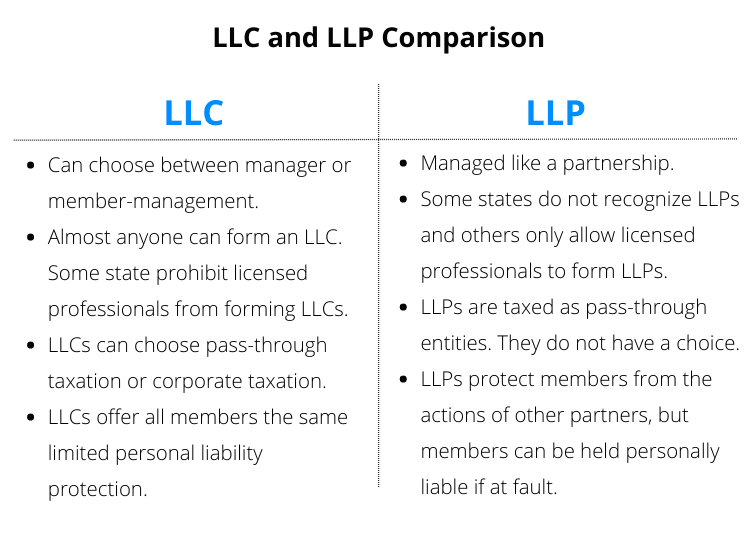

LLP vs LLC: Whats the Difference And Which One is Best for You?

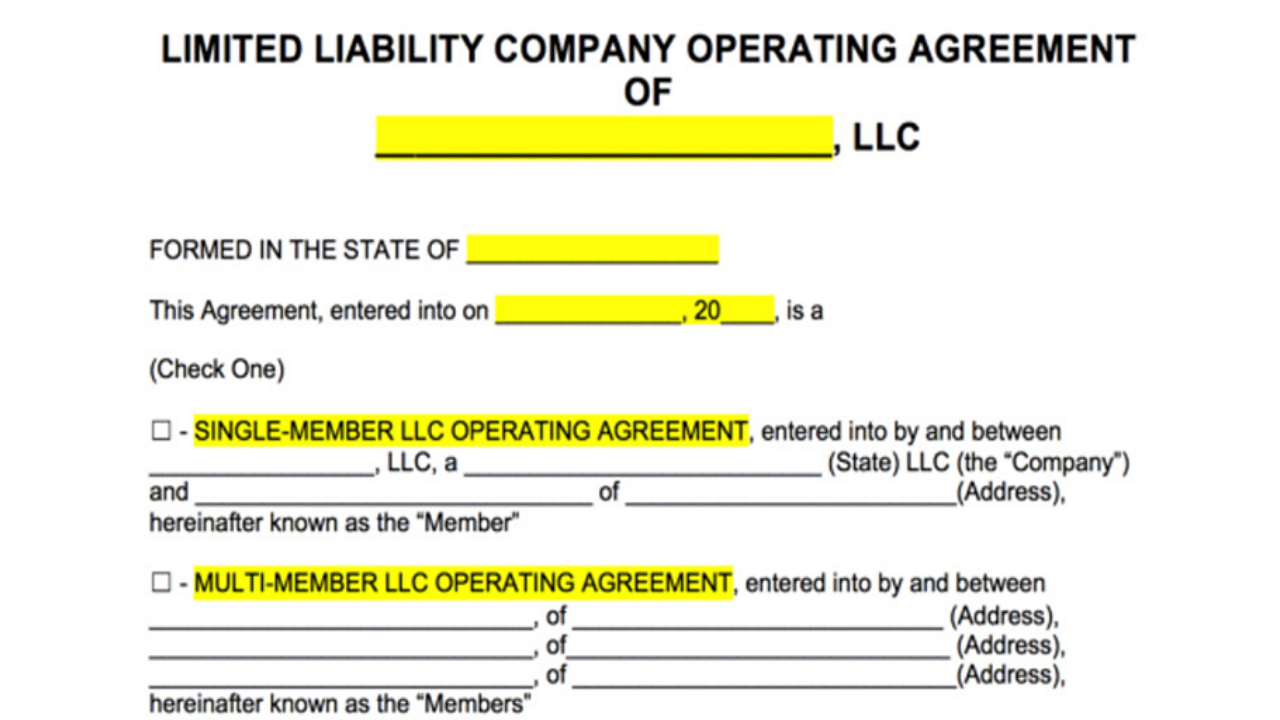

How to Start an LLC

Real Estate LLC - Do Real Estate Agents need an LLC? - (Updated 2024!)

What You Should Know About Forming an LLC in the U.S. Virgin Islands

What You Need To Know About LLCs - in North Carolina and Beyond, Certum Solutions — QuickBooks

Poland LLC / Limited Liability Company Formation and Benefits, How to Apply for Poland Limited Liability Company

Partnership vs. LLC - 3 Key Differences

BizGuide - How To Start a Limited Liability Company in Nevada