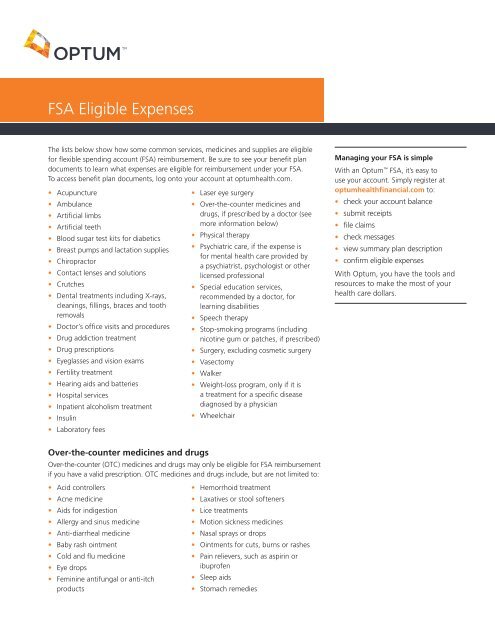

HSA Eligible Expenses

$ 21.99 · 4.7 (313) · In stock

DataPath helps TPAs get where they want to grow through innovative solutions for CDH accounts, COBRA, billing, and well-being benefits.

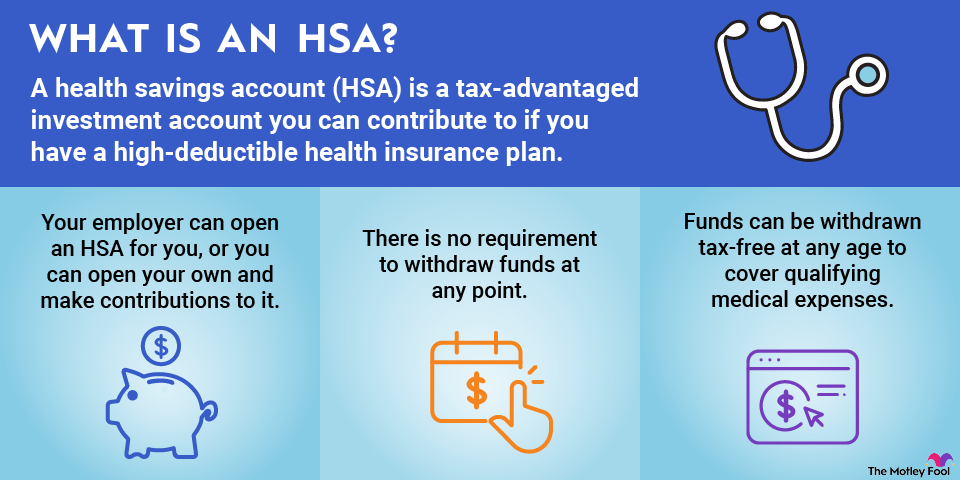

Since they were enacted in 2003, Health Savings Accounts (HSAs) have become an integral part of the consumer directed healthcare landscape for those with a high deductible health plan. One of the chief benefits of having an HSA is that account holders can use that money to pay for a wide range of eligible medical expenses for themselves, their spouses, and their tax dependents.

Save Money: Baby Monitors Eligible for FSA or HSA Reimbursement

Health Savings Accounts (HSAs) Explained

HSA & FSA Eligible Expenses - Modern Frugality

Oded Shekel on LinkedIn: Silver - Automatically Collect, Identify, and Submit FSA/HSA Eligible…

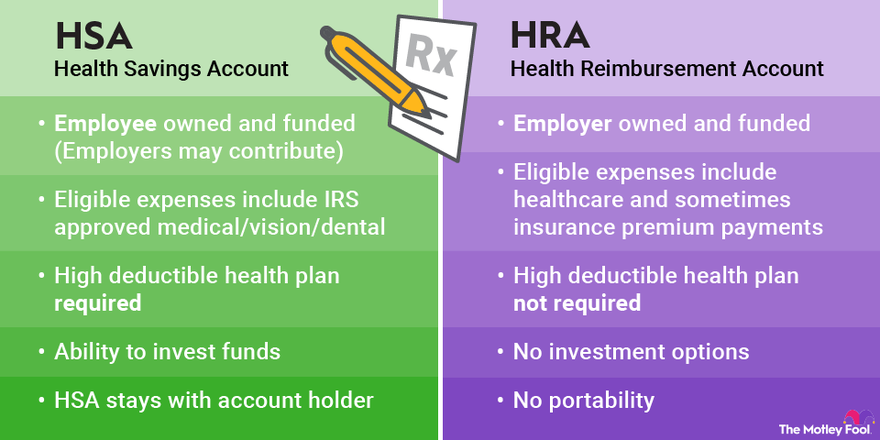

HRA vs. HSA Accounts: Compare Differences and Pros and Cons

Irs qualified medical expenses hsa - passpery

HSA Eligible Expenses

FSA Eligible Expenses - OptumHealth.com

Are Diapers FSA / HSA Eligible?

What to Know About HSA Qualified Expenses: Discover HSA-Eligible Expen – Miss EmpowHer