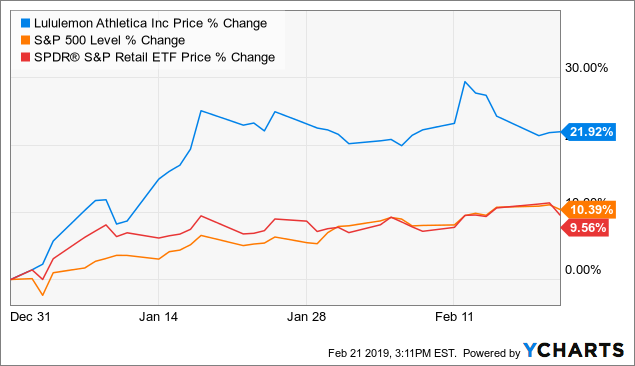

Why Lululemon's 2019 Profits Should Have Grown Nearly 30% Despite A Sharp Increase In Expenses

$ 7.50 · 5 (596) · In stock

Lululemon Athletica Inc. (NASDAQ: LULU) has achieved robust growth over 2015-18, with the company’s revenue increasing a whopping 59%. But the apparel company’s expenses following a similar trend over this period – resulting in profits remaining broadly level.

Lululemon Athletica Inc. (NASDAQ: LULU) has achieved robust growth over 2015-18, with the company’s revenue increasing a whopping 59%. But the apparel company’s expenses following a similar trend over this period – resulting in profits remaining broadly level.

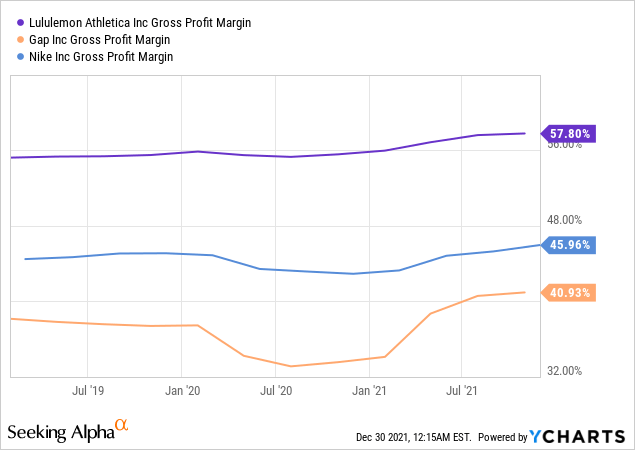

Lululemon: A Great Financial Fitness Plan (NASDAQ:LULU)

Lululemon Valuation

Realty Income Shares Have Plummeted: Buy, Hold, Or Sell? (NYSE:O)

Equilibrium: Volume 13 by Equilibrium The Undergraduate Journal of Economics - Issuu

Lululemon Athletica: Health As A Lifestyle - Secular Growth At A Reasonable Valuation (NASDAQ:LULU)

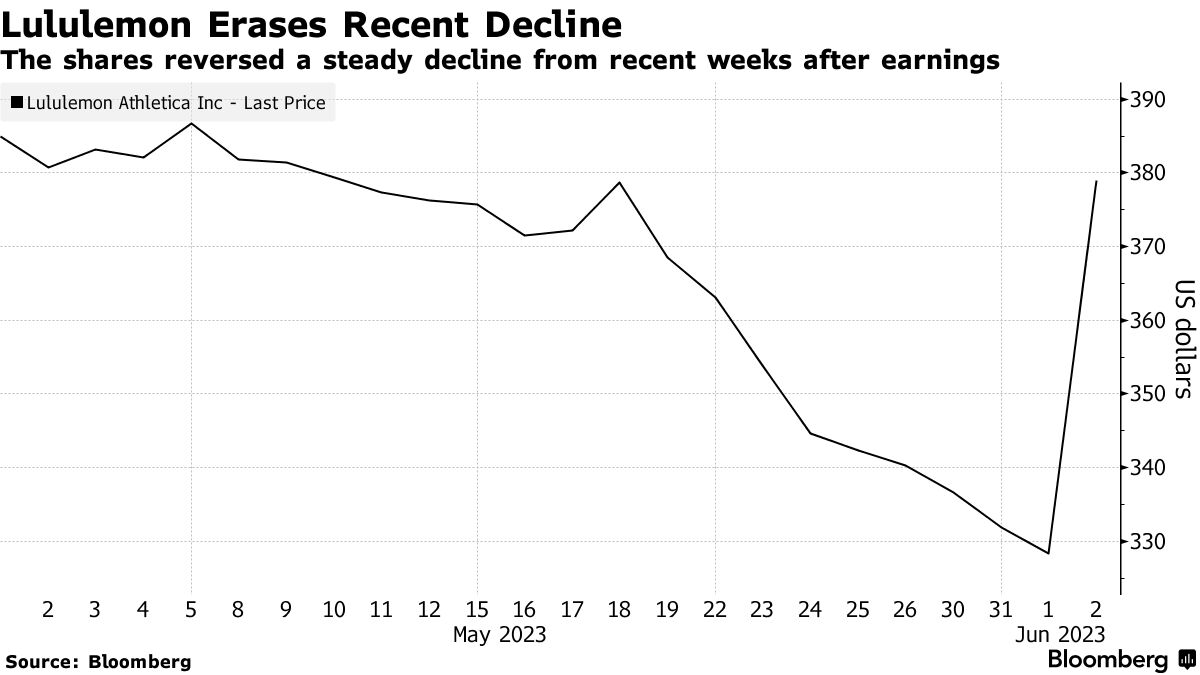

Lululemon drops most since 2020 on inventory, profit woes - BNN Bloomberg

lululemon (LULU) Raises Revenue Forecast, Faces Margin Concerns

Lululemon Hikes 2023 Guidance After Earnings Beat For Holiday Quarter; LULU Stock Soars Investor's Business Daily

Lululemon Earnings Beat Estimates as Upscale Demand Holds Up (LULU) - Bloomberg

fp0049737_1.jpg

Gymshark Marketing Campaign by ameliacundill - Issuu

lululemon: gross profit worldwide 2010-2022

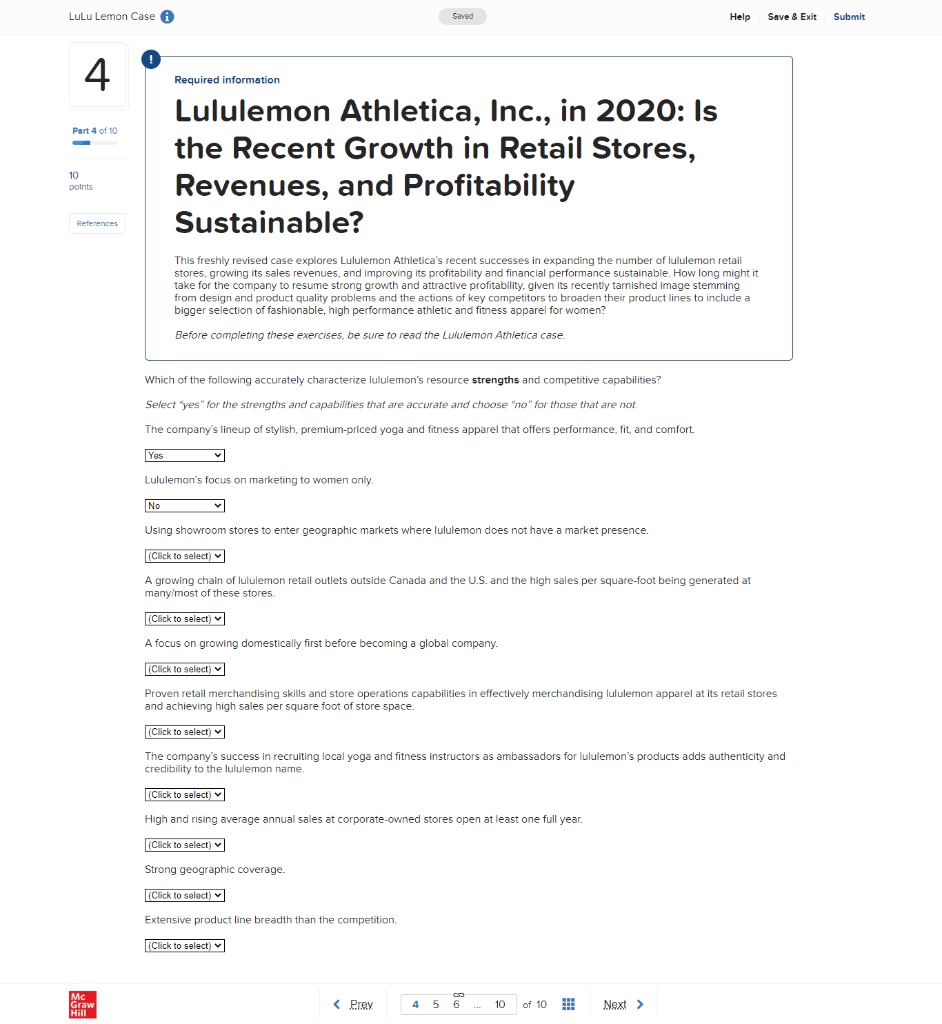

Solved Required information Lululemon Athletica, Inc., in

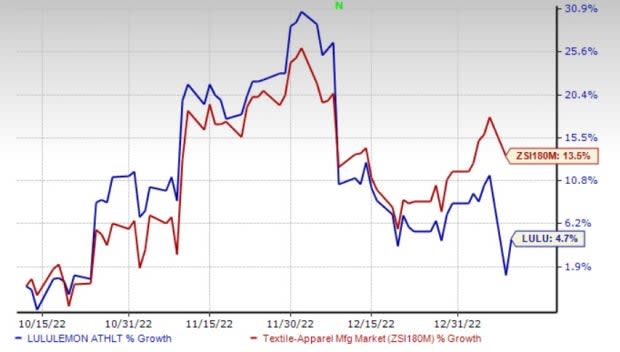

Daily stocks in the news

Lululemon Athletica Inc. Announces First Quarter Fiscal 2023 Results