Straight Line Basis Calculation Explained, With Example

$ 26.00 · 5 (90) · In stock

:max_bytes(150000):strip_icc()/StraightLineBasis-27e5ac7651b24572a05ef272c2475554.jpg)

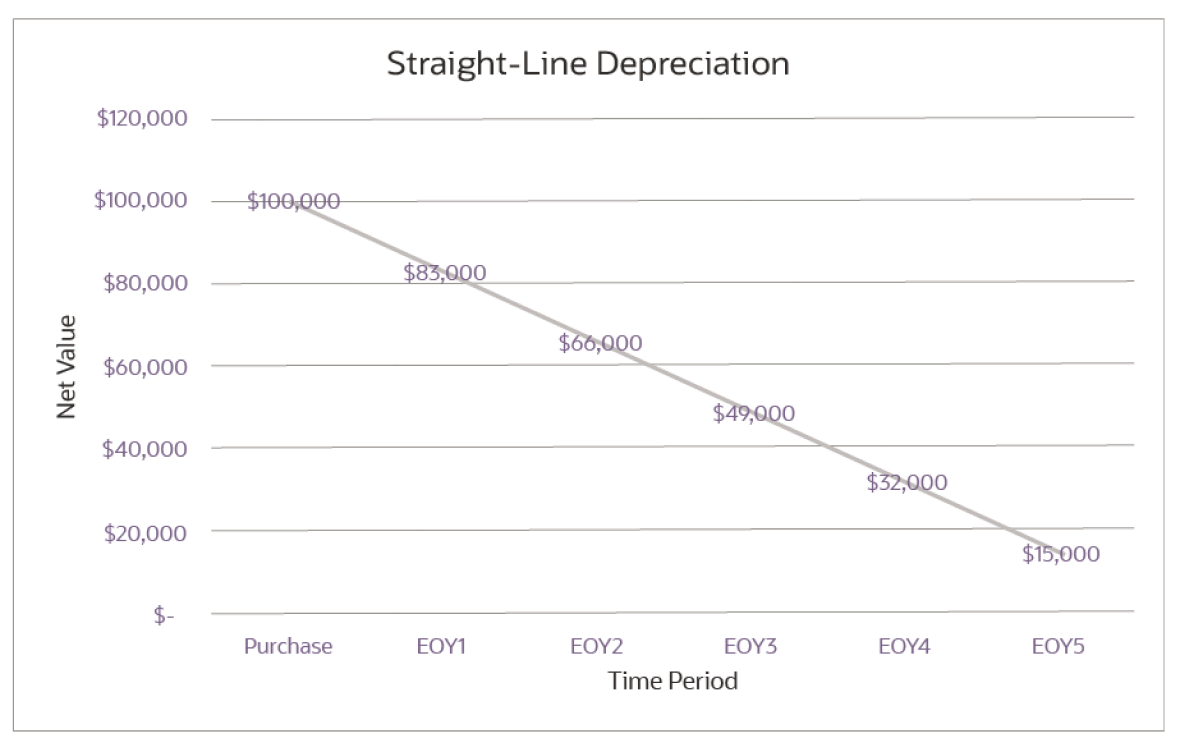

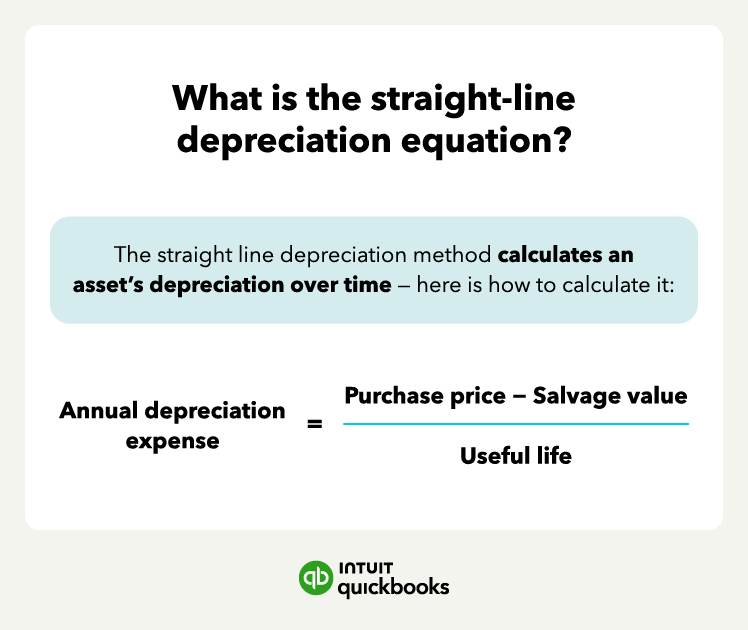

Straight line basis is the simplest method of calculating depreciation and amortization, the process of expensing an asset over a specific period.

Method Explained - FasterCapital

Straight Line Depreciation - Formula, Definition and Examples

What is the straight line depreciation method? - Quora

Straight Line Depreciation Formula

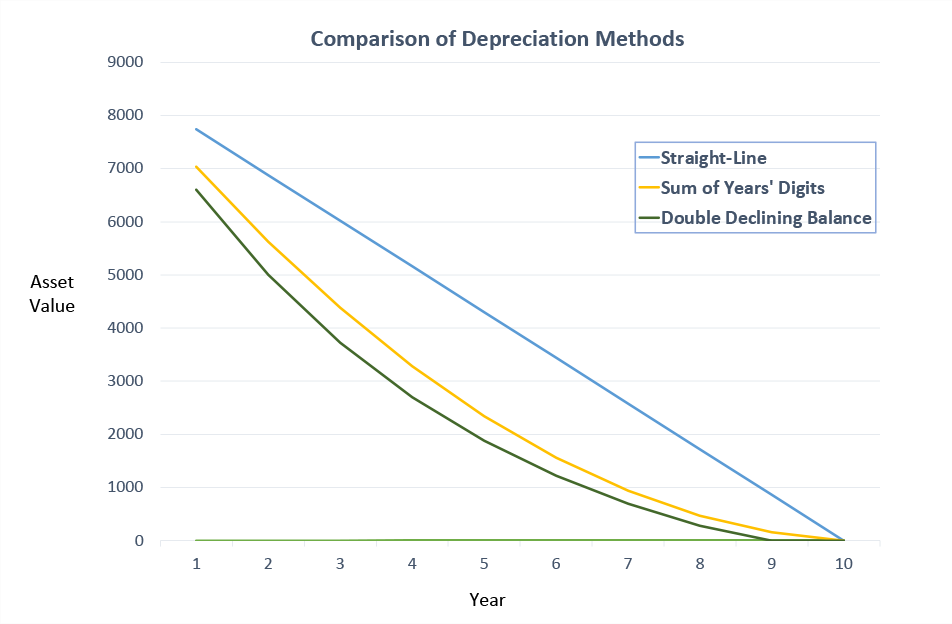

Double Declining Balance Method of Deprecitiation (Formula, Examples)

Depreciation Calculator

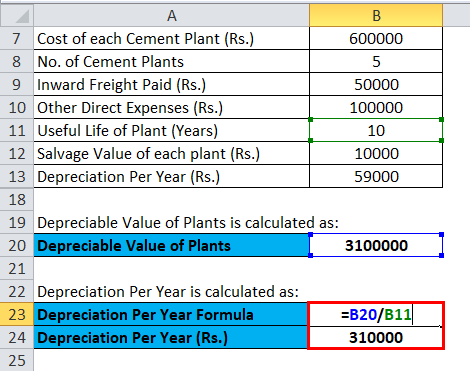

How to calculate depreciation under the straight-line method using

What Is Straight-Line Depreciation? Guide & Formula

How to calculate Depreciation Straight Line Method Depreciation

Straight Pride parade plans in Boston started by right-wing group

The straight-line depreciation formula with examples

:max_bytes(150000):strip_icc()/DDM_INV_written-down-value_df-3x2-4b8ad402814b4e1bbcd495b612dc93ad.jpg)

Written-Down Value (WDV) What It Is and How To Calculate It

How to calculate depreciation using a straight line method given a